nj tax sale certificate premium

If the interest is bid down to 1 a premium is bid up until the bidding stops to obtain the tax sale certificate. There are 2 types of tax sales in New Jersey.

Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy

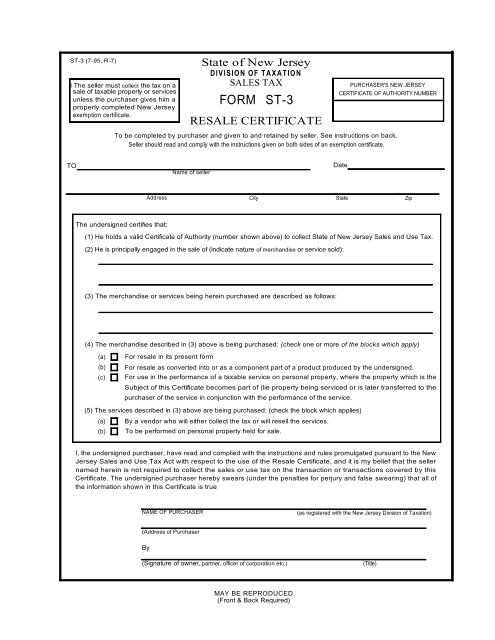

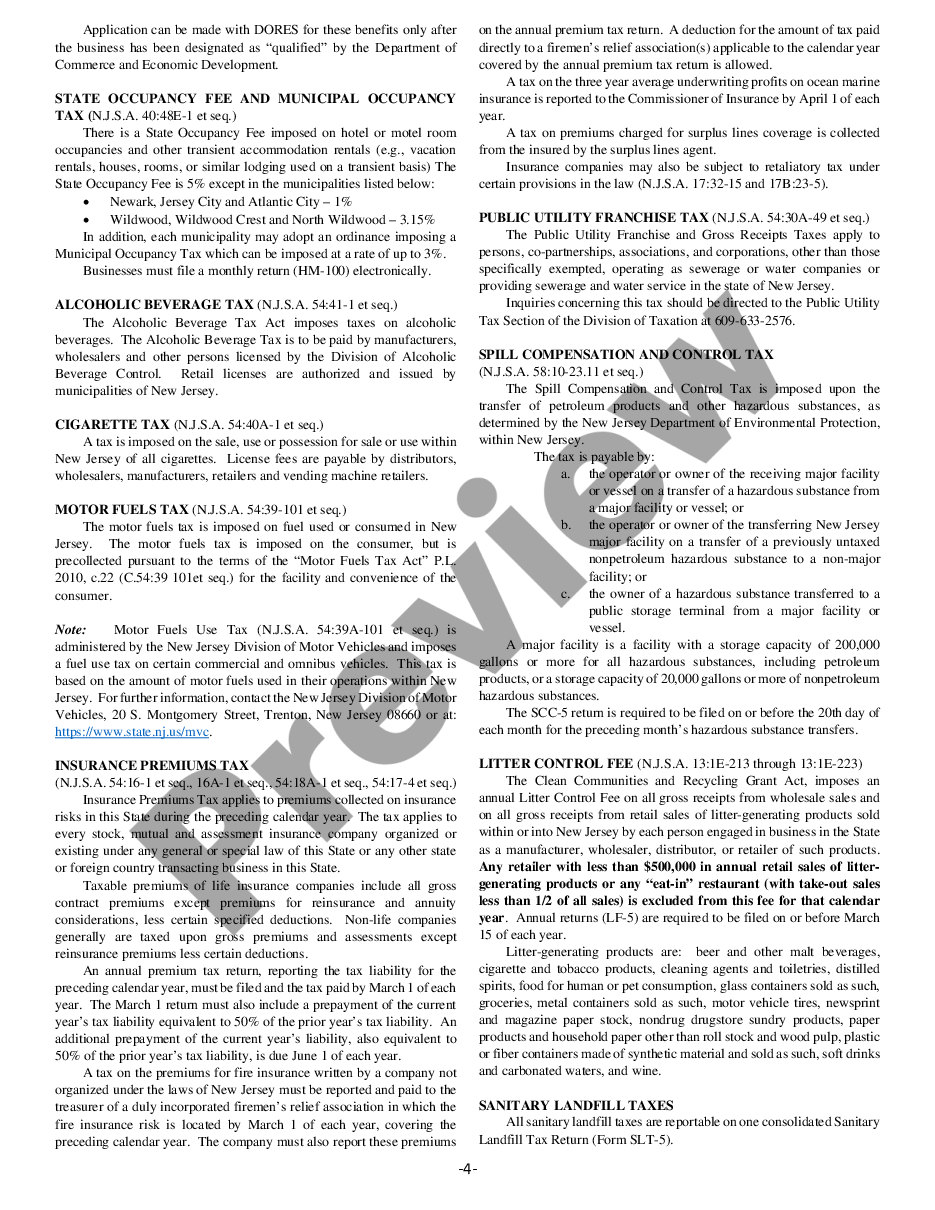

Sign Purchases and Installation Services Sales and Use Tax Effective October 1 2022.

. In New Jersey property taxes are a continuous lien on the real. More detailed information on the tax sale process in New Jersey can be found at New Jersey Tax Lien Auction Information. 2016 and prior.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax. As with any governmental activity involving property rights the process is not simple. Here is a summary of information for tax sales in New Jersey.

Purchasing a tax sale certificate is a form of investment. VINTAGE TREASURES IN HILLSBOROUGH NJ Thu Apr 28 2022 at 705 PM EDT Hillsborough New Jersey Buyers Premium. The standard tax sale is held within the current year for delinquent taxes of the prior year.

Sales and Use Tax. Select A Year. Sales and Use Tax Sign.

Nj tax sale certificate premium. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. As a statutory officer of the State of New Jersey the tax collector is obligated to follow all state statutes regarding property tax collection including billing due.

About Annual Tax Sales. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA. New Jersey Tax Certificate Process Please note.

The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption. Nj tax sale certificate premium. Purchasing a tax sale certificate is a form of investment.

Sales and Use Tax. Sales and Use Tax. Thats 5000 lien amount 200.

A Will drawn in another state can be valid. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property.

New Jersey Sales and Use Tax Energy Return. After July 1 2017. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales.

Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy

The Essential List Of Tax Lien Certificate States

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Attorney At Law Magazine New Jersey Vol 2 No 2

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Wholesaling Tax Delinquent Properties Ultimate Guide For Investors

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

New Jersey Certificate Of Formation For Domestic Limited Liability Company Llc Certificate Of Formation Nj Sample Us Legal Forms

Tax Sale Information Willingboro Township Nj

Investors Plead Guilty In Nj Tax Lien Probe Nj Spotlight News

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

The Essential List Of Tax Lien Certificate States

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube